What Does Paid in Arrears Mean?

Paid in arrears means wages are paid after the period worked. Learn payroll timing, examples, pros/cons, key rules, and how to explain arrears on paychecks.

What Is Paid in Arrears?

Paid in arrears means employees receive their wages after the pay period has ended, rather than during or before the work period. This payment timing allows employers to accurately calculate hours worked, overtime, shift differentials, bonuses, and benefit deductions before processing payroll. The lag between when work is performed and when payment is received typically ranges from a few days to two weeks, depending on pay frequency and payroll processing schedules.

Key takeaways

- Explain pay calendars during onboarding and on pay stubs (period vs. pay date).

- Choose a frequency that balances accuracy, cash flow, and expectations.

- Reconcile overtime and bonuses before processing payroll; communicate delays.

- Related: Earned wage access.

According to the American Payroll Association, approximately 75% of U.S. employers pay in arrears with lag times ranging from 3 days (weekly pay) to 15 days (monthly pay). This practice ensures payroll accuracy and compliance with overtime regulations while maintaining cash flow management for employers.

How Does Paid in Arrears Work?

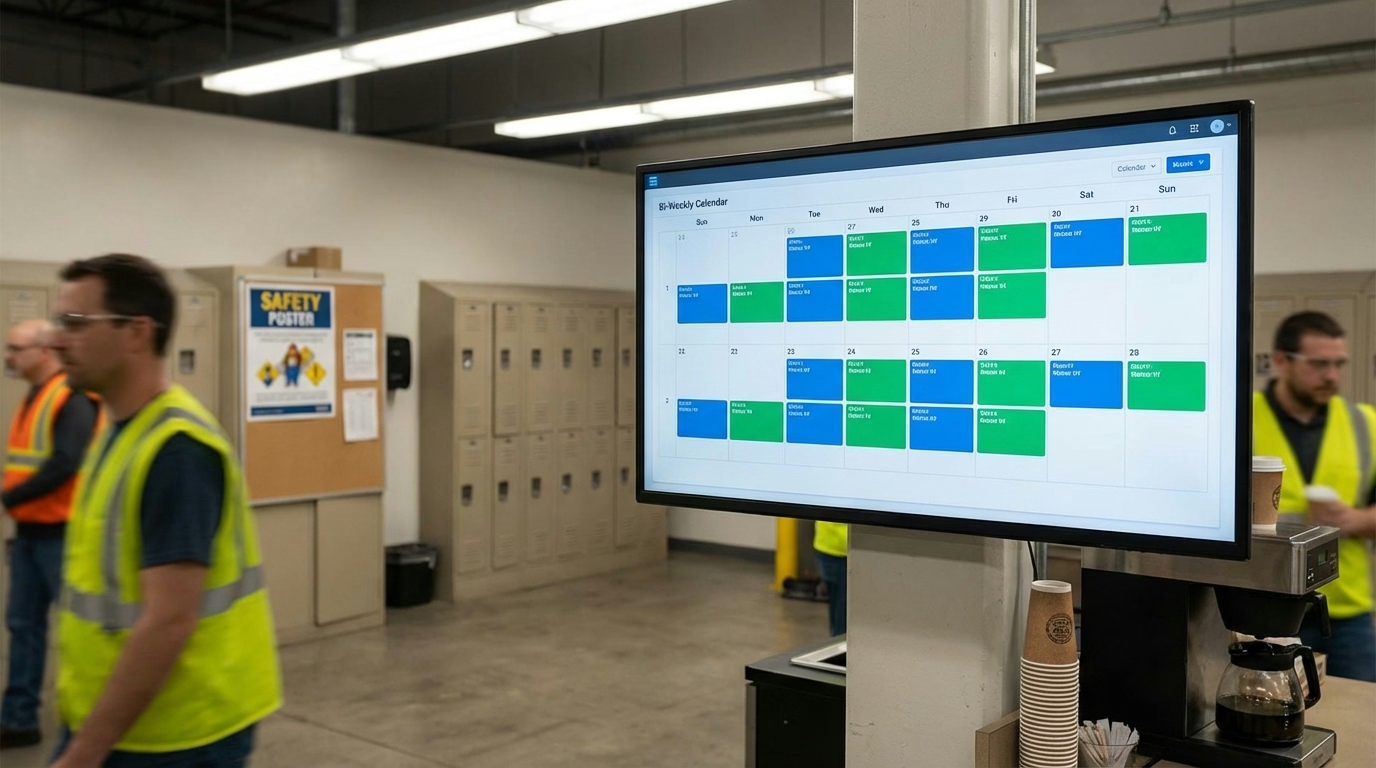

Pay period: When hours are tracked (e.g., January 1–15). Pay date: When payment is received (e.g., January 22). The arrears lag allows time for calculations, approvals, and processing.

Common lag times: Weekly (5 days), bi-weekly (12 days), semi-monthly (5–7 days), monthly (5–10 days).

Example: $20/hour employee works January 6–19 bi-weekly: 80 regular + 5 overtime hours = (80 × $20) + (5 × $30) = $1,750 gross, paid January 24.

What Is the Difference Between Paid in Arrears and Current Pay?

Paid in arrears (work Jan 1–15, paid Jan 22): Accurate variable pay calculation, time for review/correction, easier compliance, better employer cash flow. Downside: Longer employee wait, new hire challenges, cash flow difficulties.

Current pay (work Jan 1–15, paid Jan 15): Faster employee access, easier budgeting. Downside: Difficult overtime calculation before period ends, higher error risk, estimates required, overpayment risk if employee quits.

Advance pay (paid Jan 1 for work Jan 1–15): Maximum employee cash flow benefit. Downside: Overpayment risk, calculation difficulties, compliance challenges. Rarely used except for salaried exempt employees.

Most organizations use arrears for accuracy with reasonable timing.

Why Do Employers Pay in Arrears?

Accurate time/overtime: Close period, gather all records, verify hours, calculate FLSA overtime (1.5× over 40/week) accurately.

Variable pay: Calculate shift differentials, on-call pay, premium pay for holidays/overtime.

Benefit deductions: Calculate benefit deductions (insurance, 401k, HSA/FSA, garnishments) based on accurate earnings.

Processing time: Data collection, manager approvals, calculations, tax withholding, review, bank processing (ACH 1–2 days). Avoids errors.

Cash flow/error correction: Ensures employer revenue before wage payment. Allows identifying/correcting errors before payment, preventing off-cycle corrections.

Legal Requirements for Paid in Arrears

States mandate minimum pay frequency (weekly, bi-weekly, semi-monthly, or monthly) with “reasonable” lag (typically 5–15 days). Best practice: pay hourly employees within 7–10 days of period end. Final paychecks must be paid within 72 hours to 30 days after termination (varies by state and voluntary vs. involuntary). Clearly communicate frequency, periods, pay dates, and lag time in offer letters, handbooks, and onboarding.

Employee Challenges with Paid in Arrears

First paycheck delay: New hires may wait 3–4 weeks. Creates hardship for hourly workers. Solutions: Signing bonuses, earned wage access programs, shortened first period, clear communication.

Cash flow difficulties: Hourly workers struggle with 1–2 week lag. May incur late fees, overdrafts, payday loans. Acute for low-wage workers.

Final paycheck delays: May wait 1–2 weeks beyond last day, creating job transition hardship.

Employer Benefits and Communication

Benefits: Reduced errors, easier FLSA compliance, flexibility for variable schedules (split shifts, staggered shifts), simplified termination pay, better cash flow planning.

Communication: State frequency and first paycheck date in job offers. Explain frequency, periods, lag in handbooks. Show period and pay date clearly on pay stubs. Provide verbal explanation with written materials during onboarding.

Alternatives to Traditional Arrears

Earned wage access: Access 40–50% of earned wages before payday with small/no fees via mobile apps.

Weekly pay: Reduces lag from 10–14 days to 3–7 days. Tradeoff: higher processing costs, more administrative burden.

On-demand pay: Access earned wages anytime via app with instant transfer. Common in high-turnover industries.

Other solutions: Signing bonuses ($500–$1,000) for new hires, pay cards with faster availability.

Impact on Different Pay Groups

Hourly non-exempt: Most affected due to variable hours and cash flow sensitivity. Need accurate overtime calculation. Mitigate with earned wage access, weekly pay, clear communication.

Salaried exempt: Less affected due to consistent pay. Often paid on same schedule as hourly.

Commission/bonus: Month-end close needed for accuracy. Lag may extend 15–30 days.

Contractors: Paid on invoice terms (Net 30/60). Not covered by employee wage laws.

The Bottom Line

Paid in arrears means employees receive wages after the pay period ends, typically 5–10 days later for bi-weekly or semi-monthly pay. For example, work performed January 1–15 is paid on January 22. This timing allows employers to accurately calculate hours worked, overtime, shift differentials, and benefit deductions before processing payroll, reducing errors and ensuring compliance with wage and hour laws.

Approximately 75% of U.S. employers use arrears pay with lag times ranging from 3 days (weekly) to 15 days (monthly). While legal under state wage payment laws that require timely but not immediate payment, arrears pay can create cash flow challenges for hourly workers, particularly new hires who may wait 3–4 weeks for their first paycheck.

Benefits for employers include reduced payroll errors, easier FLSA compliance through accurate overtime calculation, flexibility for variable schedules, and better cash flow management. Challenges for employees include delayed first paychecks, budgeting difficulties when payment lags work by 1–2 weeks, and final paycheck delays during job transitions.

Employers can mitigate employee hardship through earned wage access programs allowing early access to earned wages, signing bonuses to bridge first paycheck gaps, weekly pay frequency reducing lag time, and clear communication about pay timing during hiring and onboarding.

Try ShiftFlow’s payroll integration tools to automate time tracking, calculate overtime accurately, manage pay groups with different frequencies, and ensure compliant arrears payment processing.

Sources

- American Payroll Association – Pay Frequency and Timing

- U.S. Department of Labor – Wage Payment Laws by State

- Society for Human Resource Management – Payroll Processing Best Practices

- Internal Revenue Service — Publication 15 (Employer’s Tax Guide): https://www.irs.gov/publications/p15

- National Conference of State Legislatures — Payday Requirements by State: https://www.ncsl.org/labor-and-employment/payday-requirements

- U.S. Department of Labor — State Labor Offices (official directory): https://www.dol.gov/agencies/whd/state

Further Reading

- Earned Wage Access Explained – Early access to earned wages

- Pay Group Management – Organizing payroll by employee categories

- Benefit Deductions Guide – Payroll deduction calculations

- On-Call Pay Policies – Compensating availability time

- Signing Bonus Strategies – Attracting new hires

Frequently Asked Questions

What does paid in arrears mean?

Paid in arrears means employees receive wages after the pay period ends, rather than during or before. For example, work performed January 1–15 is paid on January 22. This allows employers to accurately calculate hours, overtime, and deductions before processing payroll.

What is the difference between paid in arrears and current pay?

Paid in arrears: Payment after work is performed (work Jan 1–15, paid Jan 22). Current pay: Payment during the work period (work Jan 1–15, paid Jan 15). Arrears allows accurate calculation of variable pay; current pay provides faster employee access to earnings.

How long is the lag time for paid in arrears?

Typical lag times: Weekly pay: 3–7 days. Bi-weekly: 7–10 days. Semi-monthly: 5–7 days. Monthly: 5–10 days. State laws often limit maximum lag time to ensure timely wage payment.

Is being paid in arrears legal?

Yes, paid in arrears is legal and common, as long as employers comply with state wage payment frequency laws requiring payment at least monthly (or more frequently). The lag between period end and payday must be reasonable (typically 5–15 days).

When will I get my first paycheck if paid in arrears?

New hires may wait 3–4 weeks. Example: Start January 15, first period ends January 31, first paycheck arrives February 7. Ask employers about first paycheck timing during hiring to plan accordingly.

Can employers pay some employees in arrears and others currently?

Yes, employers can use different pay schedules for different employee groups (pay groups), as long as all employees are paid at least as frequently as state law requires and the practice doesn’t discriminate based on protected characteristics.